- Abstract:

- 1. INTRODUCTION

- 2. Literature Review

- 2.1. Theoretical Framework

- 2.2. Influence of Digital Accounting Tools on the Accuracy of ESG Reporting and Corporate Sustainability

- 2.3. Role and Contribution of Regulatory Environment in Determining the Effectiveness of Tools of Digital Accounting in the Reporting of ESG Performance

- 2.4. Literature Gap

- 3. Materials and Methods

- 4. Results

- 5. Discussion

- Conclusion

- Limitations

- Policy Recommendations

- Future Implications

- AVAILABILITY OF DATA AND MATERIALS

- Finding

- Conflict of interest

- Acknowledgements

- Appendix

- REFERENCES

Impact of Digital Accounting Tools on ESG (Environmental, Social, Governance) Reporting Accuracy and Corporate Sustainability Strategies: Moderating Role of Regulatory Environment

PDF

PDF

1Jubail Industrial College, Jubail, Kingdom of Saudi Arabia

Received: 28 September, 2025

Accepted: 10 December, 2025

Revised: 04 December, 2025

Published: 09 January, 2026

Abstract:

Purpose: The current study examines the effect of digital accounting technologies on ESG (Environmental, Social, and Governance) accuracy and corporate sustainability strategies and the moderating role of the regulatory environment on the relationship.

Methodology/Approach: The survey is carried out on 420 professionals in UK industries and analysed by the Partial Least Squares- Structural Equation Modelling (PLS-SEM).

Results: The results indicated that the use of digital accounting tools (β = 0.385, p < 0.001) has a positive and significant impact on corporate sustainability strategies. It also suggests that the ESG reporting accuracy is positively and significantly influenced by digital accounting tools (β = 0.430, p < 0.001). Regulatory environment also plays a moderating role during the connections between digital accounting tools and corporate sustainability strategies (β = 0.072, p < 0.01). It is also determined to be significant in the relation between digital accounting tools and ESG reporting accuracy (β = 0.119, p < 0.01).

Implication: It was concluded that the use of digital accounting technologies and regulatory mechanisms are critical to improving corporate sustainability and ESG disclosure.

Practical Implications: It is worth noting by policymakers and companies that the regulatory pressure is one of the factors that affect the efficiency of digital accounting software in improving ESG disclosures that also positively impact transparency and accountability.

Keywords: Digital accounting tools, environmental, social, governance (ESG), ESG reporting accuracy, corporate sustainability strategies, regulatory environment, digital transformation.

1. INTRODUCTION

The digital accounting tools are swiftly transforming how organisations manage and report financial information and Environmental, Social, and Governance (ESG) data (Alharbi et al., 2025). These tools enhance reporting accuracy as there is a growing demand by the stakeholders for accuracy, transparency, and ESG reporting. Additionally, these tools support the corporate sustainability strategies as disclosed by (Al-Kubaisi & Abu Khalaf, 2025; Eskantar et al., 2024). ESG reporting is under increased scrutiny in the UK, for instance, almost 46% of companies in the FTSE-100 were required to revise climate and sustainability metrics in recent years due to either error or a change of direction, with 89% of such modifications linked to greenhouse-gas emissions (Deloitte, 2024). In addition, only 65% of UK businesses now have a strategy to become net zero by 2050, and only half have even begun to quantify their carbon footprint (The Guardian, 2024). Another problem has been a lack of trust among senior leaders in reported ESG, where nearly three-quarters of UK top decision-makers are not sure that their organisations are making reliable sustainability disclosures (Gursoy et al., 2025; Julius, 2024). Meanwhile, (Lukács & Molnár, 2025; and McGachey, 2025) stress growing regulatory requirements in the UK, such as Sustainability Disclosure Requirements (SDR) in the UK, the impact of the Corporate Sustainability Reporting Directive (CSRD) through UK subsidiaries, and mandatory alignment to TCFD-style principles. These required companies to narrow data gathering, better approach to measuring Scope 1-3 emissions, and enhancement of governance concerning ESG reporting.

Nevertheless, in spite of such pressures, there are a number of fundamental problems that continue to occur with UK ESG reporting and corporate sustainability strategies. For instance, the quality and integrity of data are also poor, where several companies operate across different systems or with human-only procedures resulting in mistakes, oversights, or unsuitable measurement (Petcu et al., 2024; Robeco, 2025). Second, as per (Sakiewicz et al., 2024), the ESG metrics standardization remains a controversial issue and, accordingly, comparison across companies or industries is challenging, with the constant changes in regulations introducing uncertainty and a burden of compliance. Third, the development of corporate sustainability strategies is hindered by ineffective technological integration, where (Sander, 2025) revealed that not all companies have adequately embraced the use of the latest digital accounting or reporting systems. This results in inefficiencies, the absence of real-time reporting, and susceptibility to greenwashing or inaccurate reporting. Fourth, the regulatory environment has a moderating effect but has tendencies of being reactive as opposed to being anticipatory, where the direction is unclear, and there is a lag between new demands and the willingness of firms to undertake them. All these problems are interconnected to the extent that they adversely impact reporting accuracy and the successful implementation of sustainability strategies.

This paper attempts to evaluate these issues by examining the impact of digital accounting solutions adoption on the accuracy of ESG reporting and corporate sustainability strategies in the UK. Alongside the moderating influence of the regulatory environment on these impacts is also a part of the analysis. It bridges the research gaps of measuring the effects of digital tools in the UK context empirically and moderating the impact of regulatory implications and the connection between reporting accuracy and strategic sustainability actions (not merely disclosure). Through this, the paper will add to the academic knowledge as well as practical policy.

This study is significant because it provides evidence-based information for companies facing the challenges of rising ESG regulatory demands and bridging the gaps that exist in the current literature. This is due to the fact that literature lacks analysis regarding the interaction of the regulatory environment and digital tools, and recommendations on how industry stakeholders can enhance reporting infrastructure and align sustainability strategies. Therefore, the study contributes to the theoretical understanding of the topic and introduces a conceptual model involving the integration of digital accounting tools adoption. It further analyzes the regulatory environment as a moderating factor and the causal relationship between the adoption of reporting accuracy and the sustainability strategy. In this way, research is making a contribution to the ESG reporting and corporate governance conceptual framework. It also holds major empirical contributions on the direct impact of digital accounting tools on ESG reporting accuracy and corporate sustainability strategies, and the indirect relationship under the moderating effect of the regulatory environment. Lastly, the study makes substantial contributions to regulators of the industry and policymakers by making recommendations. The recommendations are practical in terms of design disclosure requirements and oversight mechanisms that would help to motivate the adoption of digital tools. Although it also advises firms on how to enhance internal systems and governance to achieve better ESG reporting quality and sustainability results.

2. Literature Review

2.1. Theoretical Framework

This study applies the Technology Acceptance Model (TAM) to examine the effects of the adoption and acceptance of digital technologies, which in this case pertains to the ESG reporting, and their impact on the outcomes at the organisational level. Based on TAM theory, when it comes to the acceptance of digital tools, perceived ease of use and perceived usefulness are primary factors supporting this decision (Noh et al., 2021). Regarding ESG reporting, TAM implies that, in situations where organisations see digital accounting tools, including AI, blockchain, and ERP, as easy to use and useful, they tend to integrate them into their ESG procedures more (De Silva et al., 2025; Taha & Alshurafat, 2025). These technologies simplify the data collection process by automating the process and hence uniform, and they also help organisations to satisfy the multifaceted regulatory requirements suggested by (De Silva et al., 2025) also. Also, the opportunities of the digital tools to be incorporated into the existing systems contribute to the risks of the tool being accepted, with organisations being willing to implement the technologies that can be integrated into their current working processes reflected in the findings by (Lulaj, 2025) as well.

The regulatory environment is a mediator in this process and it is assumed to influence the efficiency of digital tools and direct their adjustment to the new ESG standards. As soon as the organisations realise the utility of the digital technologies and the possibility of their easy adoption and implementation, the chances of their application to the framework of their ESG reporting systems. Consequently, the increase in the accuracy and transparent nature of their reports also emerge. This congruence with TAM suggests that the usefulness, practicality as well as the easiness of utilisation of digital tools are directly related to their implementation and adoption, in turn enhancing the effectiveness and efficiency of ESG reporting on the organisational level. According to TAM, the section will now examine the specific effects of digital accounting tools in relation to the ESG reporting quality and corporate sustainability outcomes.

2.2. Influence of Digital Accounting Tools on the Accuracy of ESG Reporting and Corporate Sustainability

Current research indicates a strong correlation between the usage of digital accounting tools and the increase in the accurateness of ESG reporting and corporate sustainability. The study also enlightened on the sustainability aspect, which is related to better economic development as well. Research indicated that the presence of a strong positive association amid GDP and CO2 emissions, implying that the higher the income rates are, the more pollution they are likely to produce. (Taha & Alshurafat, 2025) noted that increased data accuracy levels, transparency, and efficiency have a positive influence on the accounting sustainability performance as a result of such technologies, which are comprised of AI, IoT, and blockchain. This is in line with the information provided by revelations made by (De Silva et al., 2025) about the integration of digital knowledge, as the authors speak about the importance of AI and blockchain in the process of improving ESG reporting because these technologies would automatize the process and provide improved accuracy of the information, thus making companies more accountable. (Zhang & Huang, 2024) also underscore the contribution of digital transformation in the improvement of the ESG performance, which can also consequence in resilient supply with better performance and the positive influence of digitalisation on the efficiency level, including ESG performance. The study failed to highlight the broader implications of digital transformation on other facets of ESG performance.

(Marczewska et al., 2025) echo these results regarding the direct positive effect of digitalisation on ESG performance or its relative sector, that is. food industry, where ESG practises are becoming more a part of business models. Nevertheless, the article is constrained in that it was only restricted to particular industries not reflecting the effects of digitalisation on the ESG performance in other industries. Alternatively, the TAM model reveals that the perceived usefulness and ease of use of digital accounting tools are vital in the use of the tools in ESG reporting. The more organisations feel that the tools can be easily used and they can add value to enhancing the accuracy of their ESG reporting, the more likely they are to incorporate them into their sustainability practices (Noh et al., 2021). Digital accounting tools also increase transparency, automate collection of data, and improve decision-making, which is another feature that proves the effectiveness of digital accounting tools in improving reporting of ESG performance, according to the principles of TAM.

Moreover, (Zhang & Huang, 2024) discovered that digital transformation holds a substantial influence on transforming the ESG performance by reinforcing supply chain resilience, thus allowing firms to retort better to ecological, social, and governance pressures. Similarly, (Bo & Li, 2025) revealed that corporate digital transformation holds a positive influence on the performance of ESG and its reporting in Chinese companies by revealing that the amalgamation of digital technologies helps to improve corporate sustainability as well as its performance. (Li et al., 2025) even attempted to understand the effects of digital transformation as it applies to ESG performance in uncertain settings and revealed that the effects were positive and were recorded to continue in the technology-intensive and non-polluting industries. However, these studies do not consider the differences that occur in different industries.

(Zhang et al., 2025) show that firms in the high-tech industries have more positive results concerning the ESG performance than industries with lower technological capabilities. Furthermore, as (Ge, 2025) suggests, although digital transformation enhances ESG performance, the observed mechanism depends on the eminence of information disclosure and ESG-oriented investors, bringing in another dimension of the problem that has not been added to other studies. (Suhardjo et al., 2024) emphasise the contributions of digital accounting systems when it comes to increased accuracy of ESG reporting, but fail to identify the challenges of an expensive nature and possible unresponsiveness to adoption, affecting their implementation. (Lodhia et al., 2025) revealed that the use of digitally advanced technologies in accounting of sustainability is an ongoing process, and there remains a substantial number of aspects that remain unexplored by future research and can be used as potential barriers to the further improvement of ESG reporting practices. Therefore, literature indicates that digital accounting technologies can considerably increase ESG reporting quality and enhance sustainability in businesses. Hence, it is hypothesised that;

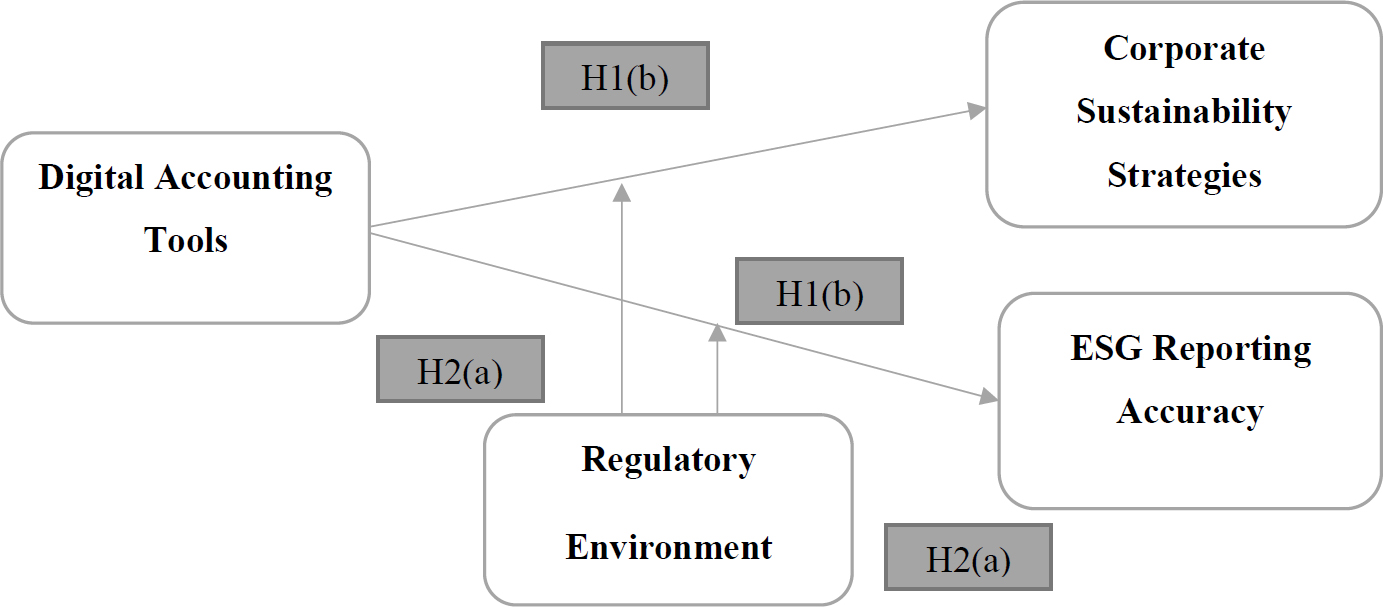

H1(a): The implementation of digital accounting tools holds a statistically significant as well as positive influence on the accuracy of reporting of ESG performance.

H1(b): The implementation of digital accounting tools holds a statistically significant as well as positive influence on the corporate sustainability strategies.

While it can be hypothesised that digital tools can improve the accuracy of ESG reporting, the next section examines how the regulatory environment determines the effectiveness and use of tools in ESG reporting.

2.3. Role and Contribution of Regulatory Environment in Determining the Effectiveness of Tools of Digital Accounting in the Reporting of ESG Performance

The role of regulatory environment and its influence on digital accounting tools in reporting of ESG has been discussed in a number of studies, most of which touch upon the growing complexity of regulatory compliance in the digital age. (Pack & Sami, 2025) examine how the digital transformation has impacted the financial reporting and ESG metrics, but fail to consider how a different regulatory regime in various jurisdictions factors into the process of blending these instruments. Similarly, (Lulaj & Brajkovic, 2025; and Saxena et al., 2022) claim that digital disruption is beneficial in ESG integration, but fail to factor in regulatory considerations that might stall the implementation in various sectors. On the other hand, (Salin et al., 2024) fail to mention regional differences in regulations despite undertaking a competency framework study around accountants in relation to ESG reporting.

As stated, and postulated by the TAM model on ESG, the regulatory environment is a moderator in that the perceived usefulness of the tools is influenced by the need to comply with regulatory requirements (Zheng & Bu, 2024). With the changing regulatory environment, organisations will tend to embrace the use of digital accounting tools as long as they find them necessary to fulfil intricate reporting needs, which is also reflected by (Williams, 2024). This is in line with the study indicating that the influence of regulatory frameworks in terms of driving success and implementation of such technologies is due to the need for organisations to enforce compliance (Taha & Alshurafat, 2025).

Additionally, (Carignan & Marvellous, 2025) absorbed on the contribution of digital accounting aid to governance and transparency, yet did not examine how varying regulatory obligations of distinct markets might influence the adoption of such technologies. However, (Carignan & Marvellous, 2025; and Yeoh, 2021) also shed light on the key benefits of AI-driven carbon accounting on ESG transparency, but the studies fail to consider the influence of law-based regulatory policies as such an aspect that would affect the use of such tools. (Lukács & Molnár, 2025) found that more firmly enforced rules can influence an ESG report to be more uniform, yet they did not further consider how digital tools may support these regulatory necessities in distinctive regulatory frameworks. These studies raise the importance of regulations, but fail to examine the implications of various regulatory environments on the actual utilisation and success of digital accounting technologies in order to report on ESG.

Standardised Regulatory guidelines and vigorously applied strategies encourage organisations to embrace digital tools since they believe it is necessitated by the need to comply with reporting requirements and guarantee compliance (Taha & Alshurafat, 2025; Zheng & Bu, 2024). Furthermore, the correspondence to the sustainability goals and ESG standards also promotes the implementation of such tools, as organisations are interested in receiving technology that would facilitate not only compliance with the regulations but also their sustainability goals in general (Williams, 2024). Hence, the regulatory clarity and enforcement are the most important determinants of the effectiveness of digital accounting tools in ESG reporting (Carignan & Marvellous, 2025; Yeoh, 2021). The available literature reviews the influence of the regulatory context and the moderating association amid digital accounting tools and sustainability strategies of corporates. Hence, it is hypothesised that;

H2(a): The Regulatory Environment moderates the influence of digital accounting tools on accuracy of ESG reporting.

H2(b): The Regulatory Setting holds statistically significant moderating impact of digital accounting tools on corporate sustainability strategies.

2.4. Literature Gap

The significance of online accounting tools to enhance the accuracy of ESG reporting has been given sufficient attention in the existing literature (De Silva et al., 2025; Taha & Alshurafat, 2025; Zatonatska et al., 2024). Nevertheless, there is a substantial gap in studying the efficacy of these tools because of the presence of regulatory frameworks. The majority of studies focus on the integration of digital technologies which are comprised of AI, IoT, and blockchain, and their direct influence on the precision of ESG reporting; yet literature lack the effect of divergent regulatory frameworks, specifically ESG regulations of the UK, in relation to the effectiveness of such technologies (Bo & Li, 2025; Zhang & Huang, 2024).

The highlighted gap is significant as the understanding of the interaction between regulatory frameworks and the digital tools in accounting may provide structured insights on the contribution of the external environment in terms of impacting tools and their implication for enhancing the excellence of ESG reporting. Because of bridging such a gap, the findings of current research can lead organisations to manoeuvre through regulatory and utilise digital tools to enhance transparency and accountability in ESG reporting. Such a contribution would improve compliance strategies and ensure that digital accounting tools are used more effectively in various regulatory settings.

Grounded on the hypothesised relationships, the conceptual model is depicted in Fig. (1).

Fig. (1). Conceptual framework.

3. Materials and Methods

3.1. Data Collection and Sample

A questionnaire survey (Appendix A) was distributed to 800 professionals holding relevant experience in various functions related to ESG reporting, corporate governance, and sustainability management. Perceptions and experience of the respondents on the use of digital accounting tools in the ESG reporting and corporate sustainability strategies were measured on a 5-point Likert scale as 1 (Strongly Agree) to 5 (Strongly Disagree) using the questionnaires. The respondents were ESG managers, corporate sustainability officers, accountants, auditors and financial analysts. They were incorporated because they possessed diverse knowledge about matters regarding the ESG reporting, and financial analysis. To determine that the participants had knowledge and experience concerning the use of digital accounting solutions to report the ESG, the purposive sampling strategy was used as outlined in the study of (Campbell et al., 2020).

Moreover, to achieve the illustrative heterogeneous sample, the participants were also chosen in a number of industries such as finance, energy, manufacturing and technology. Moreover, the companies that focused on the implementation of a digital accounting system to improve the ESG reporting was chosen. The sample was spread evenly across the industry with a 25% sample to the finance industry, 25% sample to the energy industry, 25% sample to the manufacturing industry, and 25% sample of the technology industry. The questionnaire was posted on professional networks such as LinkedIn, email lists of organisations’ business segments, and even individual rejection of companies with well-defined ESG strategies. The response rate amounted to 56%, and 450 completed questionnaires were obtained. Following the removal of unfinished or invalid responses, it could be seen that 420 valid responses were obtained, which is a good set of data to be analysed.

The effect of non-response was quantified by comparing late respondents and early respondents using the independent sample t-test, as mentioned in (Kline, 2023; and Si et al., 2023). The findings provided that there was no remarkable variation between the two groups, and this indicated that there was no bias in the sample and the results were accurate for the whole population. The sample was heterogeneous and the data collection process resulted in the reliability of the research but also in an adequate body of knowledge on the relationship between digital accounting solutions and the quality of ESG reporting. In order to measure the risk of common method bias, the study applied Harman Single Factor Test to establish the percentage of variance in the data that could be attributed to a single factor. The test revealed that the ratio of the variance attributed to the single factor was not exceeding 50, and it means that there was no severe common method bias. This enhance the validity and reliability of the findings, whereby the results were not influenced by the time of data collection or other biases. Since the study involved human participants, ethical approval from the institutional board was obtained. Further to ensure ethical considerations are kept intact, informed consent was obtained from the participants for participation in the survey and voluntary inclusion and withdrawal from the participation was also informed and communicated.

3.2. Data Analysis

Partial Least Squares Structural Equation Modelling (PLS-SEM) was aligned to analyse the data because it is appropriate to study such complex relations among several variables and process relatively small sample groups (Sarstedt & Cheah, 2019). In order to provide the measurement model validity and reliability, Confirmatory Factor Analysis (CFA) helped to test the factor loading, the composite reliability, and the Average Variance Extracted (AVE). These tests established that the measurement model was sufficient. After confirming the constructs, a path analysis was applied to examine how the digital accounting tools affected their performance on the accuracy of their ESG reporting and corporate sustainability strategies.

4. Results

4.1. Demographics

Table 1 demographic data show more men in the sample for the study, at 250 men, representing 59.5% of the sample. In comparison to this number, 170 participants were women, representing 40.5% of the sample. This reflects the predominance of men in the sample representation of the study, which may be reflective of the overall gender makeup in the professional fields covered by the survey, particularly fields that involve ESG reporting, company governance, and computerised accounting programs.

Table 1. Demographics.

| Demographic Variable | Category | Frequency | Percentage (%) |

| Gender | Male | 250 | 59.5 |

| Female | 170 | 40.5 | |

| Age | 20 – 29 years | 120 | 28.6 |

| 30 – 39 years | 160 | 38.1 | |

| 40 – 49 years | 90 | 21.4 | |

| 50 years and above | 50 | 11.9 | |

| Industry/Organisation Type | Finance | 105 | 25.0 |

| Energy | 105 | 25.0 | |

| Manufacturing | 105 | 25.0 | |

| Technology | 105 | 25.0 | |

| Total Participants | 420 | 100 |

The age group has a wide distribution, with the most concentrated group being the 30-39 years age group, with 160 respondents or 38.1% of the sample population. This is trailed by the 20-29 years of age with 120 respondents (28.6%). The 40-49 years of age had 90 respondents (21.4%), while the 50 years and older age group had 50 respondents (11.9%). The mainstream of respondents in this study are falls in the age bracket of 20 and 39, and they are a young and potentially more technologically savvy population.

The results indicate that 25% of the sample study population is evenly represented across four major industries, including Finance, Energy, Manufacturing, and Technology. This equitable allocation means that the current article covers a broader variety of views on digital accounting technology and ESG reporting in different sectors. The homogeneity of the sample makes the conclusions about the study more robust and generalisable.

4.2. Measurement Model Using Confirmatory Factor Analysis

Table 2 shows the measurement of reliability and convergent validity of constructs used in the study employing well-tested measures. The main indicators of internal constancy of latent constructs are Cronbach’s alpha and composite reliability. As (Kline, 2023) explains, the value of Cronbach’s Alpha that portends reasonable reliability of a construct is at least 0.7. The values in the current study surpass this threshold, and the values of Cronbach’s Alpha of Digital Accounting Tools (DAT) of 0.849, ESG Reporting Accuracy (ESGRA) of 0.823, Corporate Sustainability Strategies (CSS) of 0.882, and Regulatory Environment (RE) of 0.903. These values indicate a very strong internal consistency of each construct and indicate that the items representing the measure are trustworthy. Composite reliability values (0.850 to 0.918) also validate consistency and robustness in the measurement model, showing that indicators of each construct coincide with corresponding latent variables.

Table 2. Reliability and convergent validity testing.

| Constructs | Indicators | Factor loadings | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) |

| Digital Accounting Tools | DAT1 | 0.874 | 0.849 | 0.850 | 0.768 |

| DAT2 | 0.903 | ||||

| DAT3 | 0.852 | ||||

| ESG (Environmental, Social, Governance) Reporting Accuracy | ESGRA1 | 0.812 | 0.823 | 0.833 | 0.738 |

| ESGRA2 | 0.900 | ||||

| ESGRA3 | 0.864 | ||||

| Corporate Sustainability Strategies | CSS1 | 0.895 | 0.882 | 0.888 | 0.809 |

| CSS2 | 0.929 | ||||

| CSS3 | 0.874 | ||||

| To4 | 0.783 | ||||

| To5 | 0.832 | ||||

| Regulatory Environment | RE1 | 0.909 | 0.903 | 0.903 | 0.837 |

| RE2 | 0.931 | ||||

| RE3 | 0.905 |

Regarding convergent validity, the Average Variance Extracted (AVE) was also tested. It was determined by (Hair et al., 2017) that the value of AVE surpassing its threshold of 0.5 signifies an adequate convergent validity and, hence, substantial variance was covered by constructs rather than the measurement error. The AVE values of those variables to be assessed, Digital Accounting Tools, ESG Reporting Accuracy, Corporate Sustainability Strategies, and Regulatory Environment, are large (0.768, 0.738, 0.809, 0.837) and well above the 0.5 rule, which signifies strong convergent validity. It is also indicated that the factor loadings of all variables in the measurement surpasses the 0.6 level, further indicating the validity as well as internal constancy of the measurement model. The results ensure the reliability, consistency as well as validity of the study variables, which forms a strong basis for path analyses and the determination of the meaning of the relationship in the structural model.

As indicated by the statistical results in Table 3, the discriminant validity of constructs of the study is measured with Heterotrait-Monotrait (HTMT) ratio, which is a reliable approach to measure the uniqueness of latent variables and avoid such problems as multicollinearity. (Yusoff et al., 2020) state that values of HTMT that move below the critical level of 0.85 will confirm that discriminant validity is sufficient. The HTMT values, as depicted in Table 3, are below 0.85, confirming discriminant validity. The results support the studies by (Henseler et al., 2015; Hair et al., 2019), emphasising the importance of discriminant validity in confirming robustness of the measurement model.

Table 3. Discriminant validity.

| Variables | Corporate Sustainability Strategies | Digital Accounting Tools | ESG Reporting Accuracy | Regulatory Environment |

| Corporate Sustainability Strategies | ||||

| Digital Accounting Tools | 0.709 | |||

| ESG Reporting Accuracy | 0.530 | 0.601 | ||

| Regulatory Environment | 0.737 | 0.611 | 0.464 | |

| Regulatory Environment x Digital Accounting Tools | 0.296 | 0.384 | 0.131 | 0.498 |

4.3. Path Analysis

Table 4 path coefficients show positive, strong, and statistically significant relationships between the constructs. Digital Accounting Tools directly relate to Corporate Sustainability Strategies as (β = 0.385, p < 0.001), which means corporate sustainability strategies are significantly affected by digital accounting tools. Similarly, the Digital Accounting Tools to ESG Reporting Accuracy has a coefficient of (β = 0.430, p < 0.001), signifying that digital tools significantly contribute to the accuracy of ESG reporting. From these findings, the effectiveness of digital tools in improving both sustainability approaches and the accuracy of ESG disclosures becomes evident.

Table 4. Path coefficients.

| Constructs | Coefficients | T-Statistics | P-Values |

| Digital Accounting Tools -> Corporate Sustainability Strategies | 0.385*** | 8.288 | 0.000 |

| Digital Accounting Tools -> ESG Reporting Accuracy | 0.430*** | 8.007 | 0.000 |

| Regulatory Environment -> Corporate Sustainability Strategies | 0.495*** | 10.556 | 0.000 |

| Regulatory Environment -> ESG Reporting Accuracy | 0.240*** | 3.831 | 0.000 |

| Regulatory Environment x Digital Accounting Tools -> Corporate Sustainability Strategies | 0.072* | 1.883 | 0.060 |

| Regulatory Environment x Digital Accounting Tools -> ESG Reporting Accuracy | 0.119* | 1.937 | 0.053 |

Note: *(p < 0.10): Indicates statistical significance at the 10% level.

**(p < 0.05): Indicates statistical significance at the 5% level.

***(p < 0.001): Indicates statistical significance at the 1% level.

Moreover, Regulatory Environment influences Corporate Sustainability Strategies (β = 0.495, p < 0.001) and ESG Reporting Accuracy (β = 0.240, p < 0.001) considerably, reflecting that the regulations have a considerable influence on sustainability practices and enhance the accuracy of reporting on ESG. The Interaction effect of Regulatory Environment and Digital Accounting Tools on Corporate Sustainability Strategies shows a coefficient of (β = 0.072, p < 0.01), which is statistically significant at the 0.01 level and hence implies that regulatory environments have a moderate influence on the relationship between digital accounting tools and sustainability strategies. Similarly, the interaction effect on ESG Reporting Accuracy is (β = 0.119, p < 0.01), which represents a marginally significant effect.

4.4. Model Explanatory Power

The R-square in Table 5 indicates the explanatory level of the model in the explanation of the variability of the dependent variables. In the case of Corporate Sustainability Strategies, the R-squared equals 0.538, implying that variation in corporate sustainability strategies can be explained by the various independent variables incorporated in this model, accounting for around 53.8%. This implies a low to high explanatory strength of the model for the sustainability strategies. In the case of ESG Reporting Accuracy, R-squared is 0.297, indicating that the model explains 29.7% of the variance in ESG reporting accuracy. It shows that it has a relatively low explanatory power, implying that there might be other aspects that might affect the ESG reporting accuracy, other than the variables that were taken into consideration in this research.

Table 5. Predictive relevance and quality assessment.

| Variables | R-Square | R-Square Adjusted |

| Corporate Sustainability Strategies | 0.538 | 0.534 |

| ESG Reporting Accuracy | 0.297 | 0.291 |

5. Discussion

The findings have shown that there is a robust optimistic correlation amid digital accounting tools (ERP systems, blockchain) and enhanced ESG reporting accuracy and corporate sustainability strategies among UK enterprises. These findings confirm the initial hypothesis (H1), which indicates that digital devices support the ESG reporting practices and sustainability initiatives. Path analysis proved that digital tools are instrumental in guaranteeing accurateness of the data on ESG and the strategies are properly implemented. Also, the regulatory environment was found to be one of the important moderators that support the application of digital tools for complying with the requirements of the strict frameworks, such as the Sustainability Disclosure Requirements of the UK and the Corporate Sustainability Reporting Directive (CSRD) of the EU.

With results showing a strong, positive relationship between the usage of digitally advanced tools, such as ERP systems and blockchain, and better ESG reporting practices, which also enhance corporate sustainability strategies of the business enterprises in the UK. The path analysis also produced high coefficients for Digital Accounting Tools and Corporate Sustainability Strategies, highlighting that the utilisation of digitally advanced tools has a substantial impact on the accuracy of ESG information and the effectiveness of sustainability strategy within corporations. These findings can be attributed to certain industrial and sectoral factors within the context of the UK commercial enterprises. To illustrate, in the UK, (FCA, 2023) states that the finance, energy, and manufacturing industry is faced with aggressive examination by regulators and stakeholders on matters of ESG performance.

In addition, (Furness, 2025) also echoed that the Sustainability Disclosure Requirements established by the UK Government had been consistent with the TCFD principles that require firms to use modern digital accounting software to ensure proper monitoring of emissions, social performance, and governance reporting. Therefore, companies that embraced the use of digital accounting instruments were positively affected in respect to their ESG reporting effectiveness and company sustainability initiatives.

These results also correlate with the Technology Acceptance Model (TAM), which interprets the adoption behaviour, suggesting that managers perceive the digital accounting instruments as very useful towards improving the compliance of ESG and sustainability reporting. Consequently, it is likely to lessen the reputation risk and permit the amalgamation of sustainability into the corporate strategies in the long-run. This ultimately results in the adoption of high-tech, digitally furnished accounting tools in UK companies.

These results are also aligned with the existing literature, such as research by (De Silva et al., 2025; and Taha & Alshurafat, 2025), indicating that the ESG reporting process can become efficient, transparent, and timely due to new technologies. Earlier literature has been inclined to confirm that the digital transformation in the corporate systems can bring a better result in the ESG reporting procedure; however, this study can provide novel evidence and demonstrate how these tools can directly affect the quality and accuracy of the ESG disclosures made by industries and their corporate sustainability strategies. This research paper provides an improved understanding of the ways digital accounting systems work in various organisational contexts and consequently enhances sectoral variation in ESG reporting by analysing various sectors, such as finance, energy, and manufacturing.

In terms of the second hypothesis H2 of the research that tests the moderating effect of digital accounting tools on the effects of digital accounting tools on ESG reporting and corporate sustainability strategies, the results showed that there is a significant effect. The above results in the UK context are an indication of how the external regulatory environment and pressure shape the introduction of digital accounting technology in the UK firms argued by (Ge, 2025) also. In line with the disclosures of (Gonzalez et al., 2025) in the highly controlled industries of services, energy, and utilities, businesses are faced with the stringent disclosure rules of the UK disclosure regulations and the principles of the Corporate Sustainability Reporting Directive (CSRD) of the EU. This complex regulatory environment enhances the perceived usefulness of digital accounting tools aligned with TAM theory, as accounts and finance managers perceive those tools as important for competitive legitimacy and regulatory compliance.

The environment of laws and regulations was significant regulator of the association amid initiatives of corporate sustainability and digital accounting solutions because the effects of solutions would be increased with higher regulations. Such results and findings are in accordance with present literature results and indicate the significance of the regulatory environment in the acceptance and implementation of corporate ESG practices (Krueger et al., 2024; Singhania et al., 2024). The research, however, being undertaken is not limited to general regulation compliance, like in the previous studies (Pack & Sami, 2025), but includes the strict regulatory market of the UK, as a special case study, with its complicated policies developing on how ESG disclosures, which are growing more sophisticated, are affecting the conduct of the companies.

Existing literature has emphasised the significance of enhancing and harmonising ESG reporting considerably less than it has focused on the importance of varying regulations across different regions in shaping the effectiveness of digital accounting practices in increasing the precision of reporting (Lodhia et al., 2025; Lukács & Molnár, 2025). It is depicted and evidenced by the study that regulatory stringency promotes the adoption of digital tools by demonstrating that the regulatory pressure urges the acceptance and implementation of digital tools, but also by fuelling the implementation of such tools to satisfy the increased demands of similar and transparent ESG disclosures.

Conclusion

The current study highlights the critical importance of digital accounting tools in enhancing the accuracy and reliability of ESG reporting in the business environment in the UK, as well as analysing the moderating effect of the regulatory environment. As revealed by the findings, the uptake of modern technologies like ERP and blockchain has become all the more crucial in the UK context as companies react to Sustainability Disclosure Requirements (SDR), compulsory TCFD-compliant reporting, as well as to an increasing level of investor scrutiny. The tools are found to increase transparency, comparability, and timeliness of ESG reports, and these tools have a direct link to more credible corporate sustainability planning. The results prove that the efficiency of such technologies is highly determined by the changing regulatory environment in the UK, as it not only enforces their use but also increases their influence in the realisation of the sustainability goals in key sectors of the economy, including finance, energy, and manufacturing.

Limitations

While the contribution of this research is priceless, some limitations must be mentioned. First, the study geographically takes place in the UK, and therefore, the results have the potential to limit the external validity of the study to other regions with different regulatory systems. The nature of the study using self-reported survey responses can cause bias, especially in the perceptions of the participants towards digital accounting tools. Although the research explores the role of online tools in ESG reporting, it cannot quantify the long-term sustainable impact of the tools and the industry-specific issues that need to be addressed in further research.

Policy Recommendations

The findings of the study lead to certain major policy recommendations.

Regulatory Standardisation: The UK regulators are advised to consider more standardized and more detailed policies of ESG reporting to improve the accuracy and consistency of ESG reporting. These policies will improve the current issues in ESG reporting by enhancing the use of digital accounting tools.

Government Incentives: The UK government ought to provide incentives, including tax reliefs and subsidies, to encourage the use of digital accounting tools, especially to SMEs. This would also assist businesses in enhancing their accuracy in reporting of ESG, and in line with the dynamic regulatory requirements.

International Cooperation: The international regulatory cooperation should be encouraged as a way of harmonising ESG standards in the international system. Through the development of international cooperation, UK firms will be in a more favourable position to adhere to global ESG requirements and homogeneous and transparent reporting standards in various markets.

Future Implications

Future studies must investigate the use of digital accounting tools in ESG reporting among the UK’s various industries to understand how these tools behave in other environments. More studies on the role of digital tools on the sustainability of the UK firms in the long term and their capacity to generate both environmental and social impacts would give a more in-depth insight into their possibilities. It would also focus on the research on the impact of different standards in the UK local and global regulations on the adaptation and efficiency of these solutions, providing a broader picture of how companies within various countries can successfully employ digital solutions in their ESG practices. Moreover, longitudinal analyses may look at the evolving effectiveness of digital bookkeeping technologies over time, particularly as regulatory frameworks continue to tighten and stakeholder pressures intensify.

AVAILABILITY OF DATA AND MATERIALS

The data will be made available on reasonable request by contacting the corresponding author.

Finding

None.

Conflict of interest

The authors declare no conflicts of interest.

Acknowledgements

Declared None.

Appendix

Survey Questionnaire

Section A: Demographic Profiles

1) Gender

- Male

- Female

2) Age

- 20 – 29 years

- 30 – 39 years

- 40 – 49 years

- 50 years and above

3) Industry/Organisation Type

- Finance

- Energy

- Manufacturing

- Technology

Section B: Digital Accounting Tools

Rate the following based on the 5-point scale as below.

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| I find the digital accounting tools used in our organisation efficient in improving the accuracy of ESG reporting. | |||||

| The integration of digital accounting tools such as ERP and blockchain has enhanced the transparency of our ESG reporting. | |||||

| The use of digital accounting tools in our company has significantly improved the timeliness of ESG data reporting |

Section C: ESG (Environmental, Social, Governance) Reporting Accuracy

Rate the following based on the 5-point scale as below.

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| The accuracy of our ESG reports has improved significantly with the adoption of digital accounting tools. | |||||

| I believe that our ESG reports are now more reliable and consistent due to the use of digital accounting systems. | |||||

| The digital tools we use have made our ESG reporting more aligned with international standards. |

Section D: Corporate Sustainability Strategies

Rate the following based on the 5-point scale as below.

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| Our organisation’s sustainability strategies have improved with the integration of digital accounting tools. | |||||

| The use of digital accounting tools has helped us to align our sustainability strategies with global sustainability standards. | |||||

| Digital accounting solutions play a major role in enhancing the effectiveness of our corporate sustainability strategies. |

Section E: Regulatory Environment

Rate the following based on the 5-point scale as below.

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral,4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| The regulatory environment has a significant impact on the effectiveness of digital accounting tools in improving ESG reporting. | |||||

| I believe that the increasing regulatory pressure has encouraged the adoption of digital accounting tools for ESG reporting in our organisation. | |||||

| The regulatory environment in the UK has played a crucial role in shaping our company’s approach to ESG reporting through digital accounting tools. |

REFERENCES

Alharbi, K. M., Elshamly, A., & Mahgoub, I. G. (2025). Do Regulatory Pressures and Stakeholder Expectations Drive CSR Adherence in the Chemical Industry? Sustainability, 17(5), 2128. https://doi.org/10.3390/su17052128.

Al-Kubaisi, M. K., & Abu Khalaf, B. (2025). Climate governance, ESG reporting, and the firm performance: does it matter more for Europe or the GCC? Sustainability, 17(9), 3761. https://doi.org/10.3390/su17093761.

Bo, L., & Li, J. (2025). The Impact of ESG and Corporate Digital Transformation on Corporate Performance in Chinese firms. Sustainable Futures, 100774. https://doi.org/10.1016/j.sftr.2025.100774.

Campbell, S., Greenwood, M., Prior, S., Shearer, T., Walkem, K., Young, S., … & Walker, K. (2020). Purposive sampling: complex or simple? Research case examples. Journal of research in Nursing, 25(8), 652-661. https://doi.org/10.1177/1744987120927206.

Carignan, A., & Marvelous, O. (2025). AI-Driven Carbon Accounting: The Key to Enhancing Transparency in Global ESG Standards. Business, Economics and Management DOI:10.20944/preprints202503. 0602.v1.

De Silva, P., Gunarathne, N., & Kumar, S. (2025). Exploring the impact of digital knowledge, integration and performance on sustainable accounting, reporting and assurance. Meditari Accountancy Research, 33(2), 497-552. https://doi.org/10.1108/MEDAR-02-2024-2383.

Deloitte. (2024). Nearly half of the UK’s largest companies made restatements on climate and sustainability, as new reporting rules loom (no date) Deloitte United Kingdom. Retrieved from https://www.deloitte.com/uk/en/about/press-room/nearly-half-of-the-uks-largest-companies-made-restatements-on-climate-and-sustainability-as-new-reporting-rules-loom.html.

Eskantar, M., Zopounidis, C., Doumpos, M., Galariotis, E., & Guesmi, K. (2024). Navigating ESG complexity: An in-depth analysis of sustainability criteria, frameworks, and impact assessment. International Review of Financial Analysis, 95, 103380. https://doi.org/10.1016/j.irfa.2024.103380.

FCA. (2023). Sustainability Disclosure Requirements (SDR) and investment labels This relates to. https://www.fca.org.uk/publication/policy/ps23-16.pdf.

Furness, V. (2025). British business slows climate action, sees government net zero agenda as unrealistic. Reuters. https://www.reuters.com/sustainability/boards-policy-regulation/british-business-slows-climate-action-sees-government-net-zero-agenda-2025-07-21.

Ge, Q. (2025). Digital Transformation and Corporate ESG Performance: A Mechanism Test Based on Information Disclosure and Investor Shareholding. Advances in Economics Management and Political Sciences, 192(1), pp.58–70. DOI: https://doi.org/10.54254/2754-1169/2025.bl24155.

Gonzalez, E. D., Sijariya, R., Singh, A. K., & Garg, V. (2025). Integrating Climate Change, Social Responsibility and Electronic Financial Inclusion: A Pathway to Sustainable Development. In Climate Change and Social Responsibility (pp. 147-164). Emerald Publishing Limited. https://doi.org/10.1108/S2043-052320250000025008.

Gursoy, D., Başer, G., & Chi, C. G. (2025). Corporate digital responsibility: navigating ethical, societal, and environmental challenges in the digital age and exploring future research directions. Journal of Hospitality Marketing & Management, 34(3), 305-324. https://doi.org/10.1080/19368623.2025.2465634.

Hair Jr, J. F., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107-123. https://doi.org/10.1504/IJMDA.2017.087624.

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European business review, 31(1), 2-24. https://doi.org/10.1108/EBR-11-2018-0203.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the academy of marketing science, 43(1), 115-135. https://doi.org/10.1007/s11747-014-0403-8.

Julius, S. A. (2024). The Digital Transformation of Accounting Standards: Past Developments, Current Practices, and Future Directions for Research. International Journal of Novel Research in Marketing Management and Economics, 11(3), 94-108. DOI: https://doi.org/10.5281/zenodo.14353182.

Kline, R. B. (2023). Principles and practice of structural equation modeling. Guilford publications. https://www.scirp.org/reference/referencespapers?referenceid=3710690.

Krueger, P., Sautner, Z., Tang, D. Y., & Zhong, R. (2024). The effects of mandatory ESG disclosure around the world. Journal of Accounting Research, 62(5), 1795-1847. https://doi.org/10.1111/1475-679X.12548.

Li, J., Ding, N., Park, S. B., & Zhang, Z. (2025). How Does Digital Transformation Impact ESG Performance in Uncertain Environments? Sustainability, 17(10), 4597. https://doi.org/10.3390/su17104597.

Lodhia, S., Farooq, M. B., Sharma, U., & Zaman, R. (2025). Digital technologies and sustainability accounting, reporting and assurance: framework and research opportunities. Meditari Accountancy Research, 33(2), 417-441. https://doi.org/10.1108/MEDAR-01-2025-2796.

Lukács, B., & Molnár, P. (2025). Companies’ ESG performance under soft and hard regulation environment. Discover Sustainability, 6(1), 701. https://doi.org/10.1007/s43621-025-01657-0.

Lulaj, E., & Brajković, M. (2025). The Moderating Role of Finance, Accounting, and Digital Disruption in ESG, Financial Reporting, and Auditing: A Triple-Helix Perspective. Journal of Risk and Financial Management, 18(5), 245. https://doi.org/10.3390/jrfm18050245.

Marczewska, M., Hegerty, S. W., Panwar, R., & Kostrzewski, M. (2025). Digital transformation, ESG, and companies’ performance: an exploratory study of the European food sector. The Journal of Technology Transfer, 1-22. https://doi.org/10.1007/s10961-025-10247-1.

McGachey, K. (2025). FCA scraps SDR rollout for wealth managers. Fnlondon.com; Financial News. https://www.fnlondon.com/articles/fca-scraps-sdr-rollout-for-wealth-managers-f86f3548.

Noh, N. H. M., Raju, R., Eri, Z. D., & Ishak, S. N. H. (2021). Extending technology acceptance model (TAM) to measure the students’ acceptance of using digital tools during open and distance learning (ODL). In IOP Conference Series: Materials Science and Engineering 1176 (1), p. 012037. IOP Publishing. DOI 10.1088/1757-899X/1176/1/012037.

Pack, P. & Sami, U. (2025). Regulatory Compliance in the Age of Digital Transformation: The Role of Financial Reporting, ESG Metrics, ResearchGate. https://doi.org/10.13140/RG.2.2.27102.14405.

Petcu, M. A., Sobolevschi-David, M. I., & Curea, S. C. (2024). Integrating digital technologies in sustainability accounting and reporting: Perceptions of professional cloud computing users. Electronics, 13(14), 2684. https://doi.org/10.3390/electronics13142684.

Robeco, (2025). Task Force on Climate-related Financial Disclosures (TCFD) | Robeco Middle East. Retrieved: https://www.robeco.com/en-me/glossary/sustainable-investing/task-force-on-climate-related-financial-disclosures-tcfd.

Sakiewicz, P., Ober, J., & Kopiec, M. (2024). Challenges and opportunities of erp and scada systems in esg reporting. Scientific Papers of Silesian University of Technology. Organization & Management (214). DOI: 10.29119/1641-3466.2024.214.17.

Salin, A. S. A. P., Hasan, H. C., Kamarudin, N. N. A. N., & Mad, S. (2024). Formulating A Competency Framework for Accountants on Environment, Social and Governance (ESG) Standards and Finance Digitalization. Inf. Manag. Bus. Rev, 16, 309-317. https://core.ac.uk/download/pdf/618153274.pdf.

Sander, B. (2025). Addressing climate change in the age of artificial intelligence: three registers of human rights struggles. Transnational Legal Theory, 1-41. https://doi.org/10.1080/20414005.2025.2518900.

Sarstedt, M., & Cheah, J. H. (2019). Partial least squares structural equation modeling using SmartPLS: a software review. Journal of Marketing Analytics, https://doi.org/10.1057/s41270-019-00058-3.

Saxena, A., Singh, R., Gehlot, A., Akram, S. V., Twala, B., Singh, A., … & Priyadarshi, N. (2022). Technologies empowered environmental, social, and governance (ESG): An industry 4.0 landscape. Sustainability, 15(1), 309. https://doi.org/10.3390/su15010309.

Si, Y., Little, R. J., Mo, Y., & Sedransk, N. (2023). A case study of nonresponse bias analysis in educational assessment surveys. Journal of Educational and Behavioral Statistics, 48(3), 271-295. https://doi.org/10.3102/10769986221141074.

Singhania, M., Saini, N., Shri, C., & Bhatia, S. (2024). Cross-country comparative trend analysis in ESG regulatory framework across developed and developing nations. Management of Environmental Quality: An International Journal, 35(1), 61-100. https://doi.org/10.1108/MEQ-02-2023-0056.

Suhardjo, S., Wati, Y., Renaldo, N., Musa, S., & Cecilia, C. (2024). Implementation of Digital Accounting on the Effectiveness of Corporate Social Responsibility and Environmental, Social, and Governance Reporting. Interconnection: An Economic Perspective Horizon, 2(1), 41-49. https://doi.org/10.1002/mde.4525.

Taha, N., & Alshurafat, H. (2025). The impact of technological adoption on accounting sustainability performance in industrial enterprises. In Technological Horizons (pp. 221–228). Emerald Publishing Limited. https://doi.org/10.1108/978-1-83608-756-420251008.

The Guardian (2024) Only 65% of UK firms have plan to cut emissions to net zero, study shows (2024) The Guardian. Guardian News and Media. Retrieved from https://www.theguardian.com/business/article/2024/sep/11/only-65-of-uk-firms-have-plan-to-cut-emissions-to-net-zero-study-shows (Accessed: 18 September 2025).

Williams, E. (2024). The Role of ESG principles in enhancing financial performance in the insurance sector: A comparative study of the UK and Germany. JBMI Insight, 1(3), 13-24. https://jbmipublisher.org/system/index.php/home/article/view/22.

Yeoh, P. (2021). The Sustainability of Environmental, Social and Governance (ESG) Reporting in the US and the UK. Business Law Review, 42(6). https://doi.org/10.54648/bula2021038.

Yusoff, A. S. M., Peng, F. S., Abd Razak, F. Z., & Mustafa, W. A. (2020). Discriminant validity assessment of religious teacher acceptance: The use of HTMT criterion. In Journal of Physics: Conference Series (Vol. 1529, No. 4, p. 042045). IOP Publishing. https://iopscience.iop.org/article/10.1088/1742-6596/1529/4/042045/meta.

Zatonatska, T., Soboliev, O., Zatonatskiy, D., Dluhopolska, T., Rutkowski, M., & Rak, N. (2024). A comprehensive analysis of the best practices in applying environmental, social, and governance criteria within the energy sector. Energies, 17(12), 2950. https://doi.org/10.3390/en17122950.

Zhang, H., Liu, J., & Jiang, H. (2025). The impact of enterprise digital transformation on ESG performance: Evidence from China. Managerial and Decision Economics, 46(5), 3157-3171. https://doi.org/10.1002/mde.4525.

Zhang, M., & Huang, Z. (2024). The impact of digital transformation on ESG performance: The role of supply chain resilience. Sustainability, 16(17), 7621. https://doi.org/10.3390/su16177621.

Zheng, X., & Bu, Q. (2024). Enterprise ESG performance, digital transformation, and firm performance: Evidence from China. Sage Open, 14(4), 21582440241291680. https://doi.org/10.1177/21582440241291680.